Lenders Mortgage Insurance explained…

When buying or refinancing a home or investment property, if you’ve got less than 20% deposit you’ll be viewed by lenders as a high risk – so they use Lenders Mortgage Insurance to protect their position (they buy insurance). Understanding how it works and how it differs from bank-to-bank, you could save yourself thousands. Included […]

Genuine Savings for Home Loans explained (and how to avoid it)…

If you’re considering purchasing a home soon, you’ll need to understand how genuine savings for home loans works. What is genuine savings? Genuine savings has quite a simple definition with every lender (despite each lender being able to have their own definition): Money you’ve actually saved, and can prove you saved it. Equity in a […]

Learn Exactly How to Calculate Borrowing Power

If you’re applying for a home loan, you probably want to know how to calculate borrowing power. In fact, it’s the number one question people want to know. This topic is quite detailed and sometimes a bit dry because we’ll be digging into the details, so you can properly understand how lenders analyse your situation. […]

The Secrets to Home Loan Borrowing Power Calculations

The first thing on everyone’s lips when first discussing their home loan eligibility is what’s their borrowing power. Whilst your lender has rules to follow when assessing your home loan application such as collecting adequate proof of income, they generally make up their own rules (known as a credit policy). This will directly impact your home loan eligibility […]

Guide To Self Employed Income Proof for Home Loans

This article explores what factors a lender will consider when determining the type of self employed income proof you’ll need when you’re running your own business, and also offers a behind-the-scenes understanding of the different types of loans that are available for self employed borrowers. How to use the advice in this article? Get yourself a coffee […]

What’s changing with the new credit reporting system?

Australia’s credit scoring system is changing from 1 July 2018. It will be known as the CCR (Comprehensive Credit Reporting), and you better pay all your loans and credit cards on time or your credit report is at risk. The current credit reporting system is known as a negative credit reporting system – one that […]

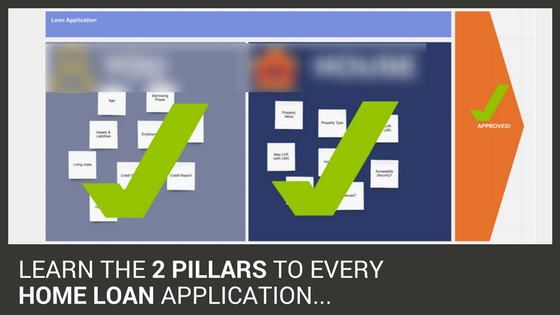

Essential Home Loan Approval Criteria

There’s only 2 home loan approval criteria that you’ll need to satisfy when completing your home loan application. Video: Essential Home Loan Approval Criteria Watch the above video for a detailed, although brief, behind-the-scenes peak at what happens in your home loan application. Home Loan Approval Criteria #1: You and Your Borrowing Power You and your […]

How a Company Car Increases Borrowing Power for a Home Loans

If your car is provided by your employer and are looking at ways to increase your home loan borrowing power, you’ll need to choose the right lender. In some instances a company car increases borrowing power and will allow you to borrow close to an extra $100,000. This works because the lender adjusts your assessable […]